Hey there! Here’s the slide-by-slide pitch deck guide I’d promised. The doc is pretty long and not a one time read. So, I recommend you bookmark this link.

This doc has been compiled basis conversations with investors at leading global VCs such as Accel, Sequoia, Matrix, Square Peg, AirTree Ventures, and angel investors from Stripe, Google, and Slack. We combined this with a 70+ page detailed report from DocSend to create a slide-by-slide guide for everyone creating a pre seed-stage pitch deck.

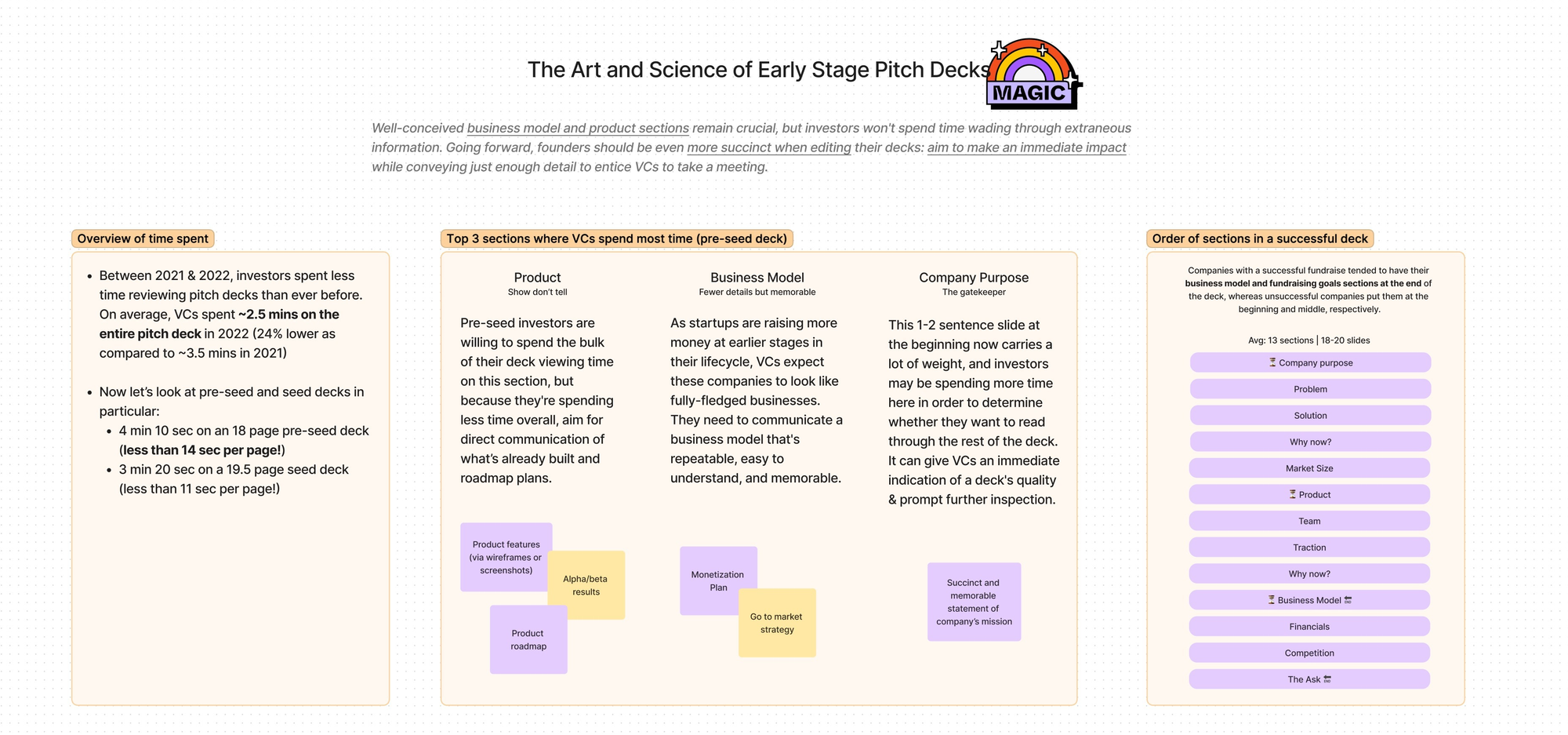

Investors have ~2.5 mins to form an initial impression and make a decision to engage further. You need to convey the right amount of information: too little and they lack context, too much and you increase their cognitive load. Remember: You as a founder know 10x more about the space than most investors and need to bring them up to speed in a convenient manner.

If you prefer to focus on your story and your venture and leave the presentation busywork to us, you can craft your pitch in a new presentation format, Chronicle. Here is an exclusive sneak peek 👀 for you. Sign up to the Chronicle waitlist today.

Here is a summary of what we’ve learned:

Why does a pitch deck matter?

The pitch deck is a means for founders to tell their story in a consistent and concise manner throughout their fundraising journey. The pitch deck is your first impression, a trust building element. It is your opportunity to get a foot-in-the-door:

- Share async over email to get the first meeting OR

- Share sync in the first meeting to pique investor interest

In order to build conviction, we rely on founders to tell us a compelling story, almost always in the form of slides. We’ve funded companies almost entirely because of the quality of their seed decks. Poor deck? We’ll likely pass on the opportunity. ~ Delian Asparouhov, investor at Khosla Ventures

The story must explain at a fundamental level why you exist. Why does the world need your company? Why do we need to be doing what we’re doing and why is it important? You can have a great product, but a compelling story puts the company into motion. The mistake people make is thinking the story is just about marketing. No, the story is the strategy. If you make your story better you make the strategy better. ~ Ben Horowitz, founder a16z

Overall advice and how to stand out

- 🕊️ Share a story, not just a deck: Keeping in mind the order of sections given below, start off by writing 10-15 headlines that sum up your startup and your story. And then begin building your slides. Remember, narratives are much easier to digest than lots of text, facts, and stats. Investors should be able to relate with your problem and product.

- 🕵️♂️ Option to deep-dive where required: Investors often have specific questions they’re looking to answer through your deck - both before and after your live presentation. Ensure that your deck contains answers to the most important questions upfront or in the appendix and can easily be discovered. At the same time, ensure you are not overloading them with too much information. They are spending ~2.5 mins per deck and prefer a summary of key points with the option to get more details where required (as one would do in a live/sync meeting).

- 📬 Include your contact info in the deck: Simple but often missed. Remember that your deck travels - among various investors in a VC and among angel investors. They need an easy way to reach out to you without having to dig deep in the email chain. It is best to mention your contact details on the first and the last page of the deck.

- ⌚ Always updated: The fundraising process generally takes a few months and involves pitching to multiple investors. Through this time, your early stage venture might progress quite a bit. It is good practice to ensure that all metrics, product images, infographics, and milestones are updated and everyone has access to the latest version of the pitch deck. You can also go one step further: Listen to investor feedback and questions after each meeting, identify gaps and update the deck with relevant information before the next chat.

- 💭 Share thoughts and assumptions: Investors recognize that there are many unknowns at the pre-seed and seed level. Therefore they are often testing your logic (e.g., with market sizing) and not that the number itself. At the same time, remember that more generalist the investor, the more detail they may require to understand context (e.g., if revenue expectations are lower in your industry, a generalist might need to hear that).

- 🎯 Practice before you pitch: Do a few rounds of practice run-throughs of the pitch deck with 2-4 people in your network who know and understand the process (investors, founders, ex-founders, etc.) to iron out the key points and eliminate the most obvious mistakes.

If you prefer to focus on your story and your venture and leave the presentation busywork to us, you can craft your pitch in a new presentation format, Chronicle. Here is an exclusive sneak peek 👀 for you. Sign up to the Chronicle waitlist today.

Ideal order of sections in a successful pitch deck

- Company Purpose

- Problem

- Solution

- Why now?

- Market size

- Product

- Team

- Traction

- Business model (incl. GTM)

- Financials

- Competition

- The Ask

Since you’re sharing a story and not just a collection of slides, avoid naming the pages in your pitch deck ‘The Problem’ or ‘The Solution’. Make the most of the valuable real estate in the title of every page and write a story that flows from one page to another. (Refer point #1 in the overall advice above)

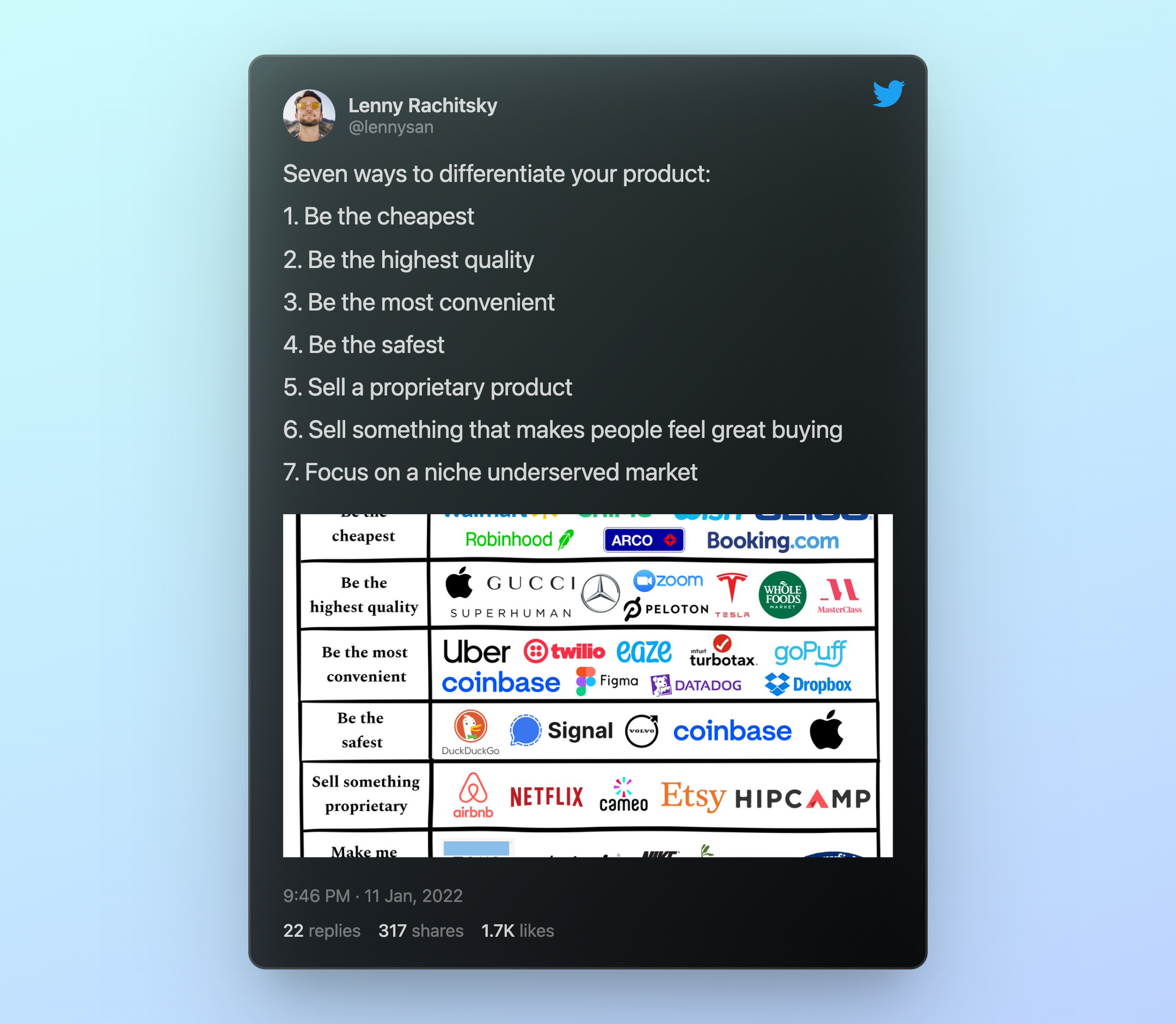

One of the best investments you could do before starting with your pitch deck would be subscribing to Lenny Rachitsky’s newsletter ($15/month). We reference him often in the points below. We have mentioned this numerous times in the past to other founders too.

Section wise guide into what you should be covering

(Open each toggle below to find more details about the section)

♥️ Company Purpose (Top 3 in time spent)

Ideal section length: 1 page

Start with the grandest statement you can make about your startup’s impact on the future. The key question to answer is ‘What does the company ultimately aim to do?’ in a single declarative sentence. It is harder than it looks. You should avoid any feature level references and focus on the bigger picture.

Some founders support this with a personal story voiceover on why they are uniquely placed to achieve this goal.

It is important to be thoughtful and concise as you craft your company purpose as this section now has the third longest viewing time of any pre-seed deck section. Many investors use this as an early filter to form an opinion about the deck and the venture.

“If you can’t tell a credible and compelling story about your vision and how your plans will capitalize on broader societal, market, cultural, economic or other trends, you’re dead in the water. I believe my own secret to fundraising success was that I always spoke to the broader changes I saw happening in the world and my conviction about the opportunities they presented.” — Eoghan McCabe, co-founder Intercom

🤔 Problem

Ideal section length: 1-2 pages

Highlight up to three key frictions that the company aims to solve. It is important to keep this section simple, narrow, and jargon free so that anyone - be it the investor or your close friend - can understand and relate.

Supporting information can include the process and depth of understanding of the problem. It can be a combination of primary (user interviews, expert interviews) and secondary (online, desk) research. You can touch upon why existing solutions don’t work.

🧑🚀 Solution

Ideal section length: 1-2 pages

This section should immediately follow the ‘problem’ section and address the frictions listed directly. You should outline the solution in a concise, memorable, and relatable manner. Stay away from jargon and close to fundamentals.

You do NOT need to go into the specifics of the product in this section (you can do it later in the dedicated ‘product’ section). Instead you should focus on taking a 30,000ft approach and share WHY you took this particular approach, HOW you are differentiated from other solutions in your strategic approach, and HOW this unique proposition will endure.

Approach Reference: TED talk by Simon Sinek | Start with Why and A quick start guide to positioning by April Dunford

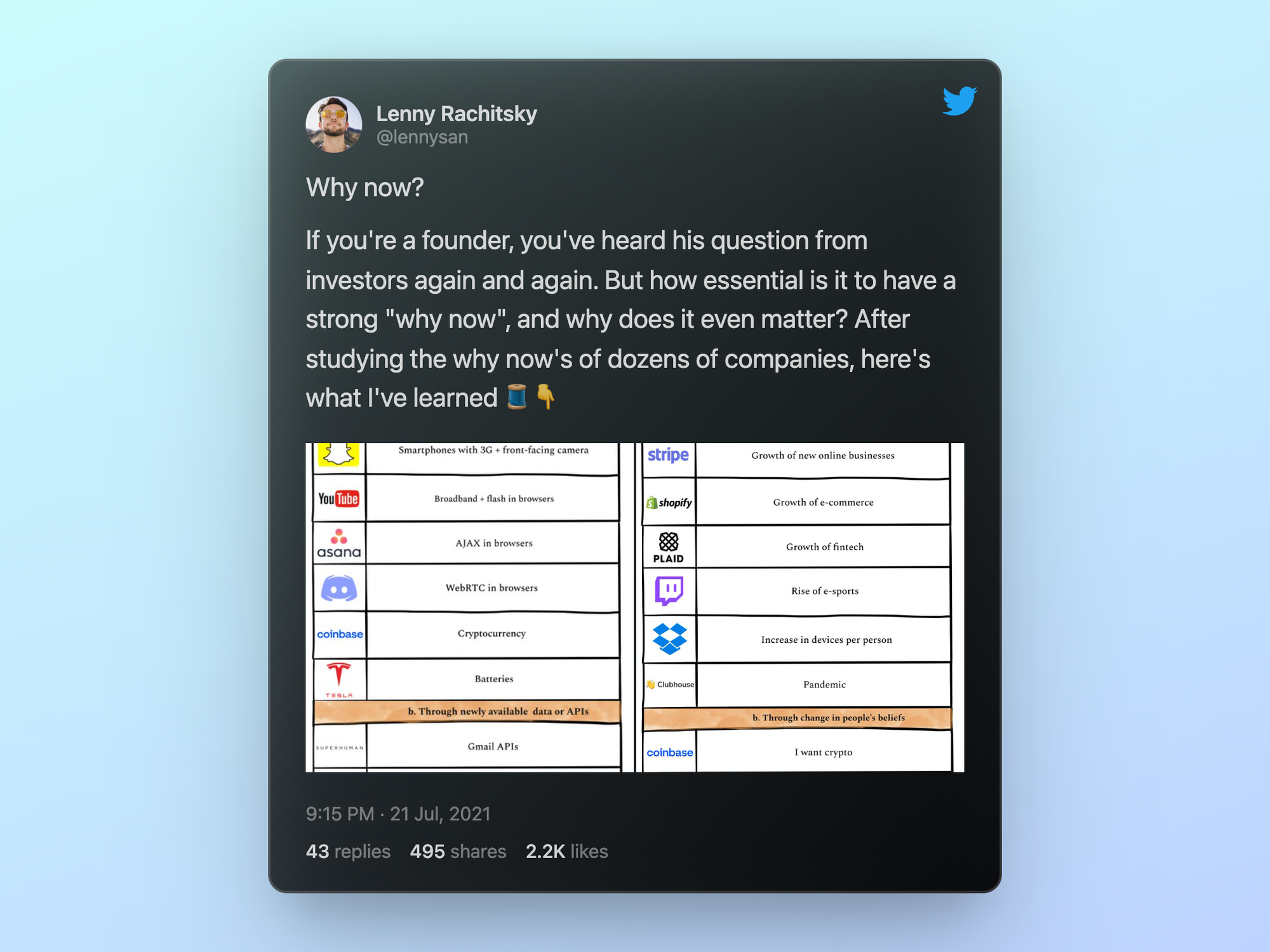

⏳ Why now?

Ideal section length: 1-2 pages

Use this section to highlight if there are any direct and relevant trends that either create a unique opportunity (e.g., Fast internet for Netflix) OR a new need (e.g.,Rise in the number of devices for Dropbox). If you do not have direct and relevant market conditions fostering your solution, feel free to EXCLUDE this section from the deck. (Only ~60% of successful pre-seed decks have this section in the deck)

Here are five sources of why now identified by Lenny Rachitsky:

- Ubiquity of a new technology (e.g., WebGL for Figma)

- Newly available data or APIs (e.g., Gmail APIs for Superhuman)

- Changes in regulation (e.g., Change in telemedicine laws for hims)

- Change in people’s behavior (e.g., Rise of e-sports for Twitch)

- Change in people’s beliefs (e.g., Reducing trust in big banks for Robinhood)

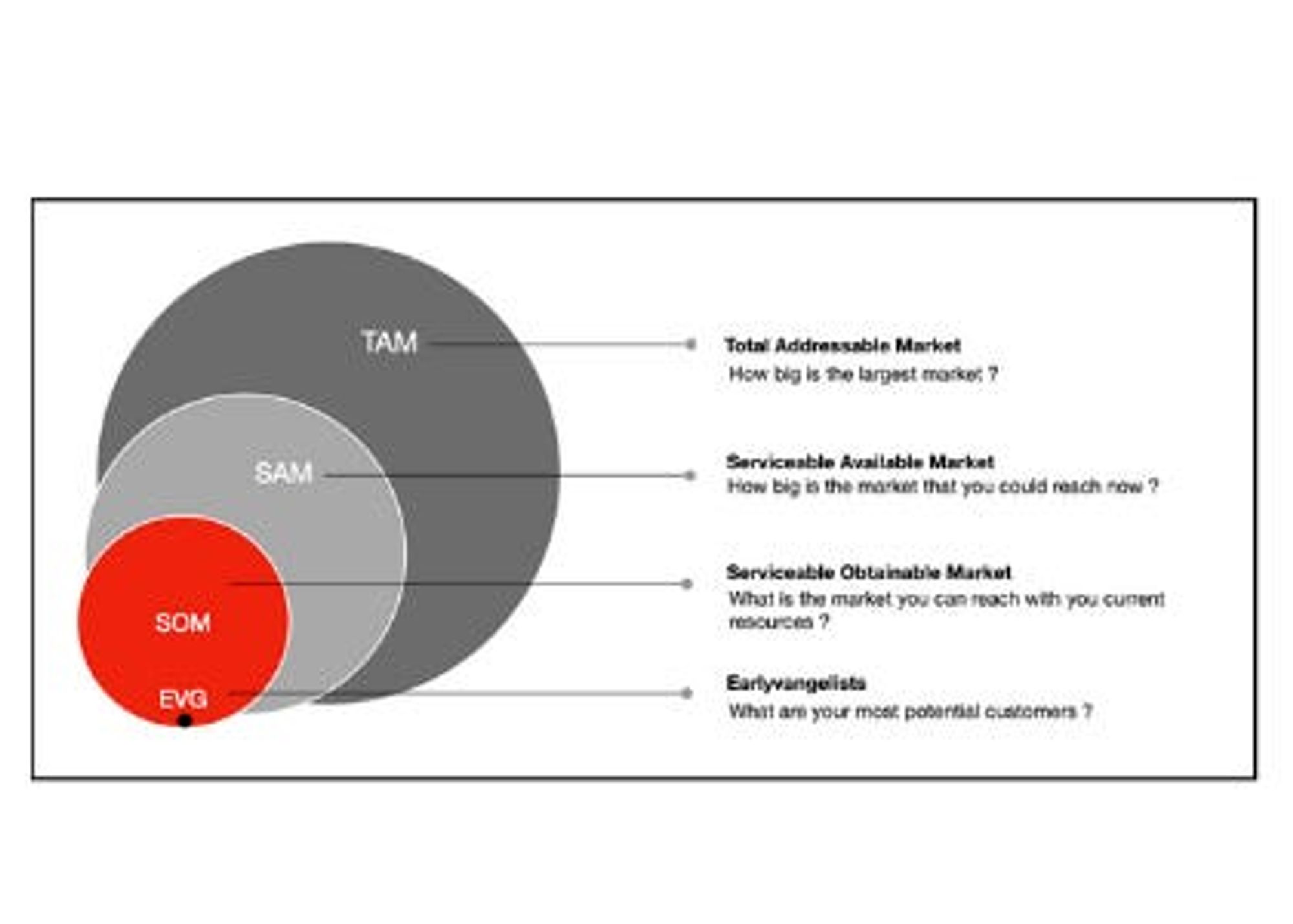

🏔️ Market size

Ideal section length: 1-2 pages

Showcase the current market size and the estimated potential for the company over the next 5-10 years. It is recommended to cover all three - TAM, SAM, SOM - in your analysis. Demonstrate that you are solving a big problem and the addressable market is big enough to warrant venture funding (Caveat: VCs have seen enough to know that TAM can expand over time and do not pass on this alone).

TAM (Total Addressable Market): How big is the largest market you could ever capture?

SAM (Serviceable Available Market): How big is the market you can capture in the medium term (keeping in mind geographical, resource, product constraints)

SOM (Serviceable Obtainable Market): How big is the market you can capture in the short term (keeping in mind geographical, resource, product constraints)

At the seed round, Docsend found that the market size section tends to be very closely linked to the purpose/problem/solution sections--these four should be thought of as tightly interwoven when hooking investors with your opening slides.

Keep calculations handy so that you can share them with investors when required. Ideally, you can link your Excel sheet to your pitch deck, so that investors have dive deep if they desire.

Further reading:

✨ Product (Top 3 in time spent)

Ideal section length: 3-4 pages

This is the most critical section of the entire pitch deck and receives the longest viewing time of any pre-seed deck section. This section should be closely linked to the strategic approach of the ‘solution’ section and illustrate 3-5 features that help address the frictions (It is helpful to share the product roadmap and future vision of the product).

- If you don’t have a working prototype: Bring your product to life with Figma mockups, wireframes, GIFs, architecture and demonstrative videos. Investors need to get a good sense of what your product experience would look like. Just words won’t be ideal.

- If you have a product/working prototype: Showcase your product experience with product images, GIFs, embedded videos of your product in action. You can also use this section to demonstrate the results of any alpha/beta tests

🧬 Team

Ideal section length: 1 page

This is the fourth most scrutinized section of a pre-seed deck. And rightly so. Investors at an early stage are investing more in the founder(s) and less in the exact idea. In most cases, the idea will go through multiple iterations before it sticks.

Your job is to showcase relevant experience in a succinct manner so that the investors have confidence in the team and their knowledge about the problem. Demonstrate how you and the team are uniquely positioned to approach the problem. This can be based on you having faced the same frictions, worked on a similar solution (even as a side project), or having deep industry expertise.

Have one simple slide covering:

- Pictures

- 2-3 sentence bios (per person) → Educational background, relevant experience, why you’re passionate about what you’re building

- Links to LinkedIn/Twitter/portfolio

Note: Don’t put your advisors as your team. They are there to help but not working with you day-in day-out.

🚀 Traction

Ideal section length: 1-3 pages

Traction helps investors solidify conviction. Notable traction at the pre-seed stage can put you in the driving seat during investor conversations. It is NOT necessary to have users using your actual product, but even 50-70 active users can make an exponential difference to the outcome of the investment discussion.

- If you don’t have a working prototype: You can showcase feedback on early wireframes, letters of intent, community response, and strength of the waitlist (A combination of #people and relevant personas)

- If you have a product/working prototype: You can showcase user testimonials, beta feedback, customer product usage analysis, results of any alpha/beta tests.

Note: If you are sharing about your waitlist it is good to share how you grew that waitlist, how you will work through that waitlist, and how you will grow it in a repeatable manner.

Further reading:

📊 Business Model (Top 3 in time spent)

Ideal section length: 2-3 pages

This section is one of the most important; it receives the second longest viewing time of any pre-seed deck section. In this section, you are expected to share:

- Go-to-market strategy: HOW will you go from 10 → 1k → 100k users and WHY you feel this approach is best suited for your startup (Make it repeatable)

- Monetization plan: Keep it high level and make it easy to understand

Go-to-market strategy (Focus on the use cases you target)

- Who are your initial customers and how do you reach them → Finding your wedge

- How to get your first 1000 consumers (B2C) or your first 10 business (B2B)

- How to find your next 10k-100k users → Finding your distribution advantage

Monetization Plan

- Inspiration for pricing your SaaS product

- Inspiration for deciding your take rate for a marketplace

Supporting Content

- Viral growth loops for organic growth

- The race car growth framework by Reforge and Lenny

💹 Financials

Ideal section length: 0-1 page

You can choose to skip this section if you do not have notable spending and return and investment to showcase. Some pre-seed companies might want to include their spend on marketing, contractors, developers to demonstrate strategic spend patterns.

🔍 Competition

Ideal section length: 1 page

Investors want to understand both the direct and indirect competition for your product. Use this section to highlight your key differences with each cluster of competitors without going into too much feature-level detail. The investors want to understand HOW your solution is unique and IF it can be a 10x improvement as compared to existing alternatives.

One way to showcase this is a competition landscape. It receives some ridicule on social media, but helps showcase the two to three key ways in which you will differentiate your solution compared to competition. Another is to use a table to include all competitors and mark the key value propositions with a check mark.

Reference: You can create a standard chart or try something completely new

How do you build an enduring multi billion dollar business: 10x product experience

🤝 The Ask

Ideal section length: 1 page

This is the last page of the deck. And your opportunity to close on a high by showcasing that you are thoughtful and strategic. Use this section to demonstrate:

- HOW MUCH you plan to raise in the round → Tied to the key metric that you plan to reach with it (e.g., 1000 paid users, 10k DAUs, High NPS etc.)

- HOW do you plan to spend that money → Keep it high level (e.g., talent, marketing, R&D)

- TIMELINE for your next few milestones → To show that you are utilizing the money well and will get to the next funding round with enough money in the bank (Here’s some reference on how long it takes to find product market fit)

Further reference:

The 2023 pitch investor pack (Pro max version!)

You’re almost there! Now that you’re ready with the master pitch deck, you’re done with most of the prep work. However, investors are now receiving more pitch decks than ever before and less than 10% of the founders get a meeting with them. So, it’s your responsibility to hook them and get interested at every stage of the journey:

- 📧 The first email communication: Most investors have a few hygiene questions to answer before they invest more time. Share a short blurb about your startup (covering what it does, key traction numbers if any, and details about the team). Along with this share a short teaser deck or Notion doc (covering problem, solution, product, team, competition, FAQs etc.). Some founders choose to attach a short 3-5 min Loom video showcasing the product. Remember that the pitch deck is your first impression, an opportunity to get a foot-in-the-door and not a place to ‘reveal all your cards’.

- 🤝 The live pitch presentation: A longer presentation deck (10-15 slides) with non-critical sections in the appendix. Most investors would have already referred to your material, formed an opinion, and decided on the themes that they want to discuss with you live. Unless there are big knowledge gaps to get over - most investors focus on building a relationship and promote organic conversation and so the pitch deck is an aid, not the focus. It is recommended to keep majority of the time for open discussion than a pitching exercise.

- 🗃️ The post-pitch share: You will have discussed a few topics in-depth during the live pitch. It is good practice to share a more thoughtful answer to those already-answered critical questions and/or answer any open questions which weren’t fully covered in the chat. You can also update your original pitch deck basis the questions you receive from investors most frequently. Sometimes you will get asked for your supporting numbers, sometimes not (e.g., market size, market wedge opportunity, traction, etc.). It helps if you ask your prospective investors in the first meeting whether they need it.

If you prefer to focus on your story and your venture and leave the presentation busywork to us, you can craft your pitch in a new presentation format, Chronicle. Here is an exclusive sneak peek 👀 for you. Sign up to the Chronicle waitlist today.

Some more resources to refer and get inspiration

Appendix

Key objectives of the initial review

Some of the the key questions investors are looking to answer from the initial, async pitch deck are:

- Hygiene: Does this opportunity align with our investment philosophy/criteria (e.g., we only invest in fintech, does this solution fit that?

- Unique Insight: What is unique about their take/insight into the problem/solution / approach etc that hasn’t been done before?

- Market potential: Is the market size and revenue/value potential attractive enough?

- Founder-Fit: What is special about this team that means they have the right to solve this problem?

If you prefer to focus on your story and your venture and leave the presentation busywork to us, you can craft your pitch in a new presentation format, Chronicle. Here is an exclusive sneak peek 👀 for you. Sign up to the Chronicle waitlist today.